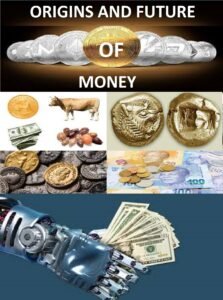

Blog: Origins and Future of Money

Insights from Clive Madamombe’s “Origins and Future of Money”

In an era where financial landscapes are rapidly changing, Clive Madamombe’s book, “Origins and Future of Money,” provides a timely and comprehensive exploration of money’s role in society. This insightful work delves into the historical development of money, its various uses, and the transformative shift from fiat to digital currencies. Madamombe expertly navigates through the past, present, and future of money, offering readers a nuanced understanding of its evolution and its implications for the global economy.

Madamombe begins his journey by examining the origins of money, tracing its development from primitive barter systems to the sophisticated financial instruments of today. He details how early societies used commodities like grains, shells, and precious metals as mediums of exchange, highlighting the gradual shift towards standardized coins and paper currency.

One of the book’s strengths is its ability to contextualize these developments within broader societal changes. For example, Madamombe explains how the rise of trade and the need for a more efficient system of exchange led to the adoption of coinage in ancient civilizations. He also explores the invention of paper money in China during the Tang Dynasty, a revolutionary shift that paved the way for modern banking systems.

The book delves into the multifaceted roles money has played in various societies. Madamombe discusses how money functions not only as a medium of exchange but also as a unit of account, a store of value, and a standard of deferred payment. By examining these roles, he sheds light on how money facilitates economic activity, supports social structures, and influences cultural norms.

Madamombe also touches on the symbolic and psychological aspects of money, exploring how it can represent power, status, and trust. He uses historical and contemporary examples to illustrate how money can both unify and divide societies, depending on its distribution and the systems in place to manage it.

One of the most compelling sections of “Origins and Future of Money” is its analysis of the current shift from fiat to digital currencies. Madamombe explains the concept of fiat money—currency that has value because a government maintains it—and its dominance in the 20th and early 21st centuries. He then contrasts this with the rise of digital currencies, which are decentralized and often operate on blockchain technology.

Madamombe provides a clear and accessible overview of cryptocurrencies like Bitcoin and Ethereum, discussing their potential to disrupt traditional financial systems. He explores the advantages of digital currencies, such as lower transaction costs and increased financial inclusion, while also addressing concerns about security, regulation, and volatility.

Looking ahead, Madamombe speculates on the future trajectory of money. He envisions a world where digital currencies could become mainstream, supported by advances in technology and changes in consumer behavior. He also considers the role of central bank digital currencies (CBDCs), which are being explored by various governments as a way to modernize their financial systems while retaining regulatory control.

Madamombe’s predictions are grounded in a thorough analysis of current trends and potential scenarios. He discusses how the evolution of money could impact global trade, monetary policy, and economic stability. By doing so, he provides readers with a framework to understand the ongoing transformation and to anticipate its potential outcomes.

Clive Madamombe’s “Origins and Future of Money” is a masterful exploration of one of humanity’s most important inventions. Through a blend of historical analysis and forward-looking insights, Madamombe offers a rich narrative that is both informative and thought-provoking. This book is essential reading for anyone interested in the past, present, and future of money. It equips readers with the knowledge to navigate an evolving financial landscape and to understand the profound changes shaping our world.